Regulation

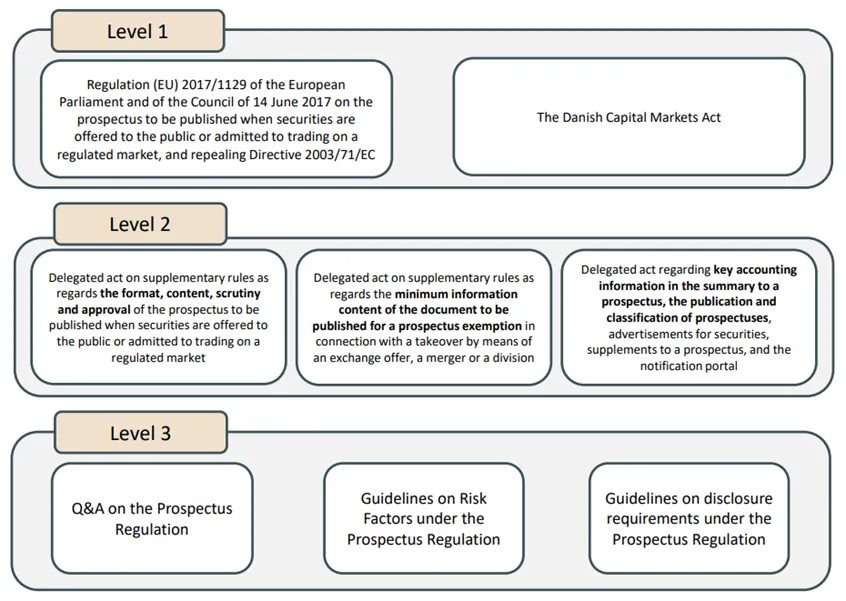

The regulation of prospectuses is trilateral. The rules are found in Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017 on the prospectus to be published when securities are offered to the public or admitted to trading on a regulated market, and repealing Di-rective 2003/71/EC. The regulation is applicable as from 21 July 2019. A regulation is directly appli-cable in all member states, and therefore the regulation in its entirety is also applicable in Denmark.

Moreover, level 2 acts in the form of delegated regulations and regulatory technical standards further lay down specific requirements to e.g. the contents of prospectuses. Furthermore, ESMA has at level 3 prepared Q&A’s and guidelines the purpose of which is to contribute to the understanding of the regulatory framework at both level 1 and 2. The level 3 documents are updated and published by ESMA on a current basis. The list of all legislation is available on the website of the Danish FSA (FSA) and is currently updated as ESMA prepares additional material.

Contact

All inquiries regarding prospectuses must be emailed to prospekter@ftnet.dk.

When the advisers have been informed of who at the DFSA is responsible of reviewing the prospec-tus, any discussions and filings of the prospectus should be addressed directly to them.

Timetable

When a prospectus is to be published, the FSA recommends that the issuer or the issuer’s adviser contact the capital markets office of the FSA with a view to coordinating a timetable for the pro-cessing of the prospectus.

Approval of a prospectus often involves 4-5 reviews by the FSA. Please allow 10 business days for both the initial review and for subsequent reviews. In case of a stock exchange listing where the is-suer has not previously offered securities to the public, 20 business days should be allowed for the initial review. For the following reviews, 10 business days will be required.

Besides allowing for the processing time of the FSA, the timetable should also take into considera-tion the time required by the issuer between the reviews for making amendments to the prospectus following any comments from the FSA.

The process until approval

When the timetable is in place and the prospectus is ready for the initial review with the FSA, the pro-spectus is to be forwarded, including appendices, by mail to prospekter@ftnet.dk. The FSA re-views the prospectus and returns any comments to the relevant contact person. Please note that the FSA will return the prospectus without any comments if there are too many outstanding issues. Only information about issues which are not known at the time of forwarding the prospectus to the FSA may be outstanding. Any outstanding issues must be described in an accompanying mail.

Based on the comments from the FSA, the issuer must amend the prospectus using track changes so that the amendments will be visible in the document. It is important that all amendments are al-ways made in the latest draft reviewed by the FSA. This applies no matter whether the amendments have been caused by the comments of the FSA, the market place or the issuing company.

This process will continue until the FSA has no more comments to the prospectus and can therefore approve it.

If the prospectus does not follow the numbering of the appendices exactly, the issuing company must prepare a cross reference list to be forwarded together with the prospectus. The list must in-clude page numbers and line numbers. Any items in a cross reference list which are not relevant for the issuer in question should be filled in with N/A and a brief explanation.

Tips for an effective approval process:

- The prospectus has page and line numbers.

- The cross reference list has been completed with page and line numbers.

- All amendments in the prospectus have been marked with track changes.

- Issues relating to the layout and wording of the prospectus have been clarified before forwarding.

- All relevant appendices are included.

- The prospectus has been thoroughly prepared and completed.

- Any outstanding issues are described in an accompanying mail.

Approval of the FSA

When approving a prospectus, the FSA has checked that all relevant information appears clearly from the prospectus. The approval is formal, and the FSA solely checks that the minimum require-ments regarding the content are met. The FSA does not undertake a substantive review of the pro-spectus. The issuer, offeror or person requesting admission to trading on a regulated market is re-sponsible for ensuring that the information in the prospectus is correct and complete.

The FSA approves a prospectus when there are no more comments and when the FSA has received all relevant signatures or authorisations. The issuer forwards the final version of the prospectus in which the persons responsible have signed the responsibility statement.

The FSA may also grant approval on the basis of an authorisation from the board of directors to the management of the company. The authorisation must state that the management is authorised to sign the prospectus on behalf of the board of directors. The FSA must have received the authorisa-tion. Such authorisation may also be made applicable to any future supplements to the prospectus. The authorisation may be granted as a specific authorisation in connection with the preparation of the prospectus or as a general authorisation.

The FSA sends a letter of approval to the issuer, offeror or person requesting admission to trading by digital mail. The contact person receives a copy of the approval via email. In case of securities to be admitted to trading, the FSA will also send a copy of the approval to the regulated market.

DFSA does not approve prospectuses outside of normal office hours.

Publication

When the prospectus has been approved, the issuer, offeror or person requesting admission to trad-ing makes the prospectus available to the public as soon as possible and no later than before the beginning of the offer to the public or the admission to trading, cf. article 21(1), 1st sentence, of the prospectus regulation.

In the case of a public offer of shares in a class admitted to trading for the first time, the prospectus must be available at least six business days before the closing of the offer, cf. article 21(1), 1st sen-tence, of the prospectus regulation.

A prospectus will be considered available to the public, cf. article 21(1), 2nd sentence, of the prospec-tus regulation when it is accessible in one of the following ways:

- On the website of the issuer, the offeror or the person requesting admission.

- On the website of the financial intermediaries placing or selling the securities.

- On the website of the regulated market through issuing a stock exchange announcement.

There are additional requirements to the effect that the prospectus must be published in an easily accessible place on the website. It must be possible to download and print the summary, and it must come in an electronic format that cannot be altered.

In case of references being integrated, the documents must be accessible in the same place as the prospectus.

Offers and admission to trading outside Denmark

The Danish FSA must approve prospectuses for issuers with registered office in Denmark. This is called home member state check, which means that a prospectus approved by the Danish FSA may be used if the issuer or offeror plans an offer to the public or admission to trading on a regulated market in the European Union or in one or more countries with which the European Union has en-tered into an agreement (for the financial area). The approval process for the prospectus is the same as described above.

The FSA makes a certificate of approval available to the host member state when the prospectus has been approved. This is done at the request of the issuer, the offeror or the person responsible for drawing up the prospectus, cf. article 25 of the prospectus regulation.

The FSA sends a certificate of approval to the relevant authorities in the countries in which the issuer or offeror plans an offer to the public or admission to trading.

In connection with offers or admission to trading outside Denmark, it is important to be aware of the prospectus limits in the various countries.

Admission to trading on a regulated market or an MTF

The operator of the regulated market or the MTF must approve the issuer if the securities are to be admitted to trading on that market or MTF. All correspondence with the operator must be handled between the issuer and the operator, including a timetable.

Fee

In connection with a request for approval of a prospectus, a fee of DKK 55,800 is payable to the FSA. The amount is adjusted annually, cf. section 361 of the Danish Financial Business Act.

The fee covers the prospectus as well as any supplementary prospectuses. It should be noted that the fee is to be paid for the processing of the request – not for the approval.