The limit values have been set so that, on the one hand they counteract excessive risk-taking, and on the other hand they make it possible for resilient banks to carry out profitable banking activities and offer the credit required to undertakings and households. The supervisory diamond was first introduced in June 2010.

The Danish FSA will conduct an individual and specific assessment of the extent to which public risk information must be given in the situations in which the bank exceeds the limit values in the Supervisory Diamond.

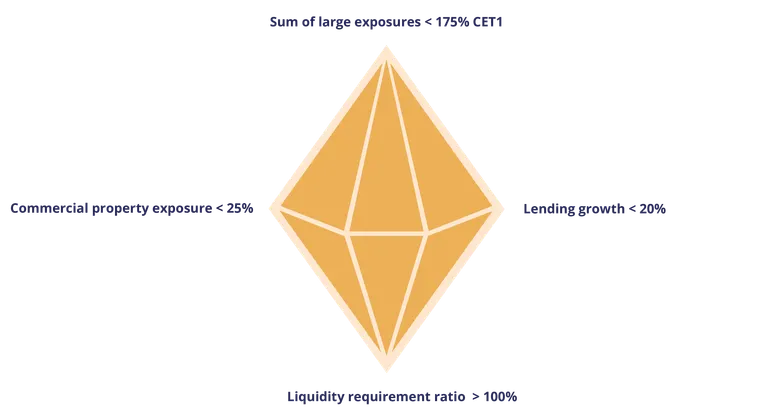

The Supervisory Diamond for banks

The Supervisory Diamond for banks sets up a number of benchmarks to indicate banking activities which initially should be regarded as having a higher risk profile.

Last updated

07-04-2025