The financial sector plays a crucial role in society and economic development in Denmark. Financial companies and markets provide the foundation for growth and prosperity, e.g., through credit, investment, insurance, and savings.

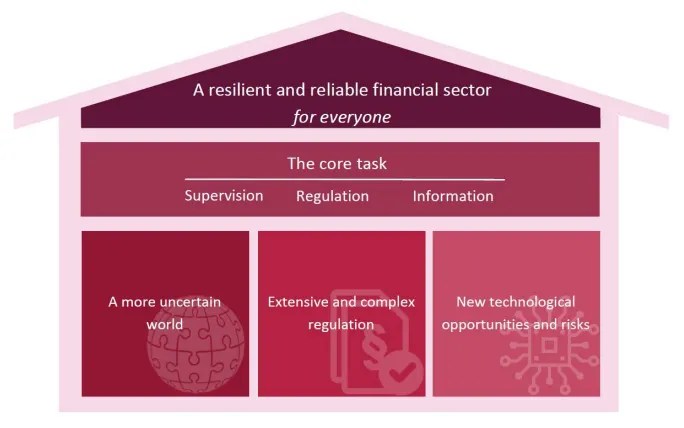

At the Danish Financial Supervisory Authority, we will, during the strategy period leading up to 2030, work towards ensuring a resilient and reliable financial sector that benefits the entire society. To do this, we will launch a number of targeted initiatives addressing the risks and trends we expect to be significant during the strategy period – illustrated by the house below.

Our core tasks include supervising the financial companies, drafting new regulations, and keeping stakeholders informed.

The core task

To contribute to growth and prosperity, financial companies take on various risks that could potentially lead to great instability if they end up entailing losses. The losses can have severe consequences not only for the individual financial companies themselves but also for affected customers – and ultimately for society at large. The goal of supervising financial institutions is to mitigate these consequences. We do this by striking the right balance between the risks companies assume and the services they provide for the benefit of consumers, businesses, and society.

Financial companies hold a special responsibility. They must act with both honesty and loyalty toward their customers, who have a right to proper advisory services and products that deliver real value.

We support resilience by ensuring that financial institutions can withstand substantial, unexpected losses and weather a period of significant headwinds. The companies must therefore maintain sufficient financial reserves to pass both national and international stress tests. Additionally, they must have the operational capacity to counter and respond to negative events, such as cyberattacks.

We support reliability by monitoring the conduct and competences of financial companies and financial markets. Companies must not only develop value-adding products, but also advise and inform customers properly when selling complex products. The products provided by the financial sector play a vital role in the lives of most Danish citizens. This includes e.g., mortgage or car loans, pension savings and other investment products, as well as home and travel insurance. The products help create security and opportunities for individuals. Financial companies must therefore live up to their promises, so that customers can have confidence that these products meet their needs.

We monitor the financial product markets and act as we deem necessary. Efficient and well-functioning capital markets connect investors and companies and are crucial for society’s economic development. The markets must be characterized by transparency and proper behavior.

Our job is to inform about the risks we see and provide consumers with information about their rights. Empowered consumers contribute to a stronger financial system.

Lastly, we maintain a focus on combating financial crime and conducting intense and targeted anti-money laundering supervision.

In the lead-up to 2030, we will further develop and strengthen our work on the core task to become more efficient and effective. We will strengthen our dialogue with companies and systematically gather stakeholder feedback. At the same time, companies must have clearer access to information outlining our expectations. We will further refine our risk-based supervision for simpler and more consistent solutions. We will also strengthen internal collaboration across professional areas, so that companies increasingly perceive and experience us as a unified institution. Finally, we will continue to develop and streamline our internal processes by, among other things, leveraging artificial intelligence to a greater extent in our work and further developing data-driven supervision methods.

Three strategic focus areas

We will concentrate our efforts on three key areas in the coming years.

1. A more uncertain world

Our world and future are becoming increasingly uncertain. Greater geopolitical tensions could potentially lead to major changes in rules-based international cooperation and affect free trade, capital mobility, and overall security. The changes could disrupt value and supply chains, negatively affect societal activity, and cause unrest in financial markets.

Increasing fraud – both nationally and internationally – poses risks of financial losses and diminished trust in the sector.

Additionally, climate change will lead to a warmer world with less climatic stability.

Operational resilience

Geopolitical uncertainty, coupled with increasing digitalization and IT dependence, introduces new risks in the financial sector. These risks are difficult to quantify but can have incredibly significant consequences for individual financial companies and society as a whole. Threat assessments highlight serious risks of both terrorism and cyberattacks. We must therefore prepare for the possibility that authorities, individual companies, and utility infrastructure may become targets of attack. The risks also extend to the financial infrastructure, which is critical to society through for example payment systems, credit access, and secure savings.

During the strategy period, we will heighten our focus on strengthening the financial sector’s operational resilience at both sector and company level.

Sustainability

Climate change entails several derivative financial risks. Increased risk of flooding could, e.g., have a negative impact on the market value of properties in the affected areas and make it more expensive or difficult to take out insurance. The transition to a climate-neutral economy also presents a number of transition risks, particularly for exposures to sectors with a large carbon footprint. Climate change in itself as well as the adaptation to it will affect the financial sector, in relation to for example risk-taking and asset valuation. Furthermore, effective supervision of the financial sector’s sustainability claims is important for protecting consumers and investors and ensuring an efficient market for ESG products.

During the strategy period, we will heighten our focus on the risks that climate change poses to the financial sector and on the information that companies provide about sustainability. Our goal is for the sector to be able to support a sustainable transition.

2. Extensive and complex regulation

Financial regulation, largely determined within the EU, is becoming increasingly complex – partly because many financial companies are inherently complex. Rules are often designed to cover a broad spectrum from small local companies to large international corporations. There is also a growing tendency for the detailed regulation to be established during the technical processing within the European Supervisory Authorities (EBA, EIOPA and ESMA). The increasing complexity and level of detail can lead to unnecessarily high adaptation costs for financial companies, and it can be difficult for customers to understand their options and rights. The volume of financial regulation from the EU is constantly growing, now exceeding 16,000 pages with associated control and supervision obligations for the Danish Financial Supervisory Authority.

During the strategy period, we will work towards simplifying financial regulation. It must be as targeted as possible and address the necessary risks without compromising financial stability or consumer and investor protection. We aim to reduce the administrative burdens on financial companies and create a genuine possibility for proportionality without relaxing the requirements. This will be supported by earlier and strategic advocacy in the EU.

3. New technological opportunities and risks

Technological changes are a constant reality and occasionally bring about significant disruption in terms of general use and distribution. Most recently, the emergence of advanced generative AI models has unlocked numerous opportunities for both established and newly founded financial companies. This introduces new types of risks that both companies and the Danish Financial Supervisory Authority must be able to manage. The adoption of new technology is appealing but must not come at the expense of business resilience and strong customer protection. Financial companies must maintain effective internal management of their use of technology and new models, and they must focus on ensuring that the use of new technology enhance their products for the benefit of customers.

We see enormous potential for new value-creating products and process improvements as a result of technological development.

This also applies to the Danish Financial Supervisory Authority’s internal operations, where technological progress will enhance our ability to fulfill our core tasks. For this reason, we are also committed to exploring ways in which technology can strengthen efforts to combat money laundering and terrorist financing across the sector, while simultaneously reducing costs for ordinary citizens and companies. the technological development also presents opportunities to enhance our data-driven supervision.

During the strategy period, we will strive for technology-neutral regulation, enabling us to address technology-related risks which we do not yet know about.